In February 2025, Mississippi fundamentally altered its direct-to-consumer alcohol landscape when Governor Tate Reeves signed legislation permitting DTC wine shipments. A multi-year lobbying effort resulted in this seismic shift for one of the most restrictive alcohol markets in the U.S.

Weeks later, Arkansas expanded its wine shipping rules to allow licensed wine retailers nationwide to ship to customers in approved municipalities. Previously, wine had to be purchased on-site at a winery to be eligible for home shipments.

The changes in Mississippi and Arkansas serve as a powerful reminder that the DTC landscape remains remarkably fluid. Years of lobbying by wine producers, changing consumer expectations, and the undeniable success of DTC models in neighboring states finally tipped the scales. For producers, this represents more than just another state opening up — it’s a signal that even the most resistant markets can evolve.

Understanding Current DTC Laws

Today, the DTC market reflects decades of incremental progress punctuated by breakthrough moments. Each beverage category operates under distinct regulatory frameworks that reflect historical biases, industry lobbying power, and consumer demand patterns.

Wine: Leading the Charge

Wine remains the DTC success story, with 47 states now permitting winery direct shipping. This dominance stems from the landmark 2005 Granholm v. Heald Supreme Court decision, which established that states couldn’t prohibit out-of-state wineries if they allowed in-state wineries to ship directly to consumers.

This game-changing decision built a solid framework that allows wineries to reach customers far beyond their region.

2025 Wine DTC landscape:

- 47 states that permit winery DTC shipping

- 3 holdout states: Utah, Delaware and Rhode Island

- Nearly $4 billion in annual DTC wine sales

- May and November represent the highest sales months

Even in prohibited states, creative workarounds exist. Rhode Island, for instance, allows consumers to purchase wine on-site at out-of-state wineries for subsequent shipping — a compromise that acknowledges consumer demand while maintaining some regulatory control.

Spirits: The Emerging Frontier

The spirits category represents the most dynamic segment of DTC sales growth. In November 2024, New York passed a law allowing spirits to be shipped directly to homes. Momentum is building for broader acceptance of distillery-to-consumer shipping.

2025 spirits DTC landscape:

- 9 states + D.C. allow DTC sales

- New York’s entry signals a potential domino effect

- Critical restrictions: Production caps often favor craft distillers

- Consumer demand: 85% of craft spirits consumers want expanded DTC access

Unlike wine, which benefits from established tourism and tasting room culture, DTC spirits sales must overcome additional safety concerns and entrenched wholesale interests. Yet the craft spirits movement — mirroring craft beer’s earlier trajectory — continues to push boundaries.

Beer: The Underserved Opportunity

Despite massive consumer demand, beer remains the most restricted DTC category. Currently, 83% of craft beer drinkers support expanding DTC shipping, but only 11 states permit it. This presents both a challenge and an opportunity.

2025 beer DTC landscape:

- 11 states + D.C. permit brewery DTC shipping

- Most permissive states: Alaska, Kentucky, Nebraska, New Hampshire, North Dakota, Ohio, Oregon, Vermont and Virginia

- Consumer demand: 75% of consumers would buy more beer if it could be shipped to their homes

- Regulatory complexity: Additional licensing requirements create barriers

The beer category’s restrictions often stem from powerful wholesale lobbyists and concerns about undermining the three-tier system. However, the craft beer industry’s continued lobbying and consumer pressure suggest these barriers may not hold indefinitely.

Navigating State-Specific DTC Compliance

Success in DTC sales requires mastering a complex matrix of state-specific regulations. Each state’s unique requirements reflect local politics, industry influence and cultural attitudes toward alcohol.

Volume Restrictions: Managing Limits

States impose varying limits on how much alcohol consumers can receive at home:

- Alabama: 12 cases per winery per consumer annually

- New York: 36 nine-liter cases of spirits per distillery per consumer annually

- Common wine limits: 2-12 cases per month, depending on state

These restrictions require sophisticated order management systems to track shipments across multiple timeframes and ensure compliance.

Production Thresholds: Size Matters

Many states restrict DTC privileges to smaller producers:

- Arizona: Only distilleries producing <20,000 gallons annually

- New York: Out-of-state distillers must produce <75,000 gallons annually

- Impact: These caps often favor craft producers over large brands

Reciprocity Requirements: The Golden Rule

States like New York and Oregon enforce reciprocal shipping rights — you can only ship to their consumers if your home state allows their producers to ship to yours. This creates a complex web of interstate dependencies that can limit market access.

Product Category Restrictions

Not all alcohol is treated equally:

- Vermont: Spirits DTC is limited to RTD cocktails under 12%

- Retailer restrictions: Many states limit retailers to wine-only shipments

- Beer specifics: Often requires additional retailer or wholesaler licenses

Implementation Strategy: Building a Scalable DTC Operation

Creating a successful DTC program requires more than understanding regulations — it demands operational excellence across multiple dimensions. It’s important to understand what is allowed and how to implement processes that ensure compliance.

Carrier Partnerships

- FedEx and UPS remain the only viable options (USPS prohibits alcohol)

- Negotiate volume rates and ensure proper adult signature protocols

- Implement backup carrier relationships for capacity constraints

Age Verification Systems

- Website age gates using third-party verification services

- Delivery protocols requiring ID checks

- Documentation systems for compliance audits

Tax Management Infrastructure

- Multi-state sales tax registration and remittance

- Excise tax calculation and payment systems

- Automated reporting for various state agencies

Technology as a Competitive Advantage

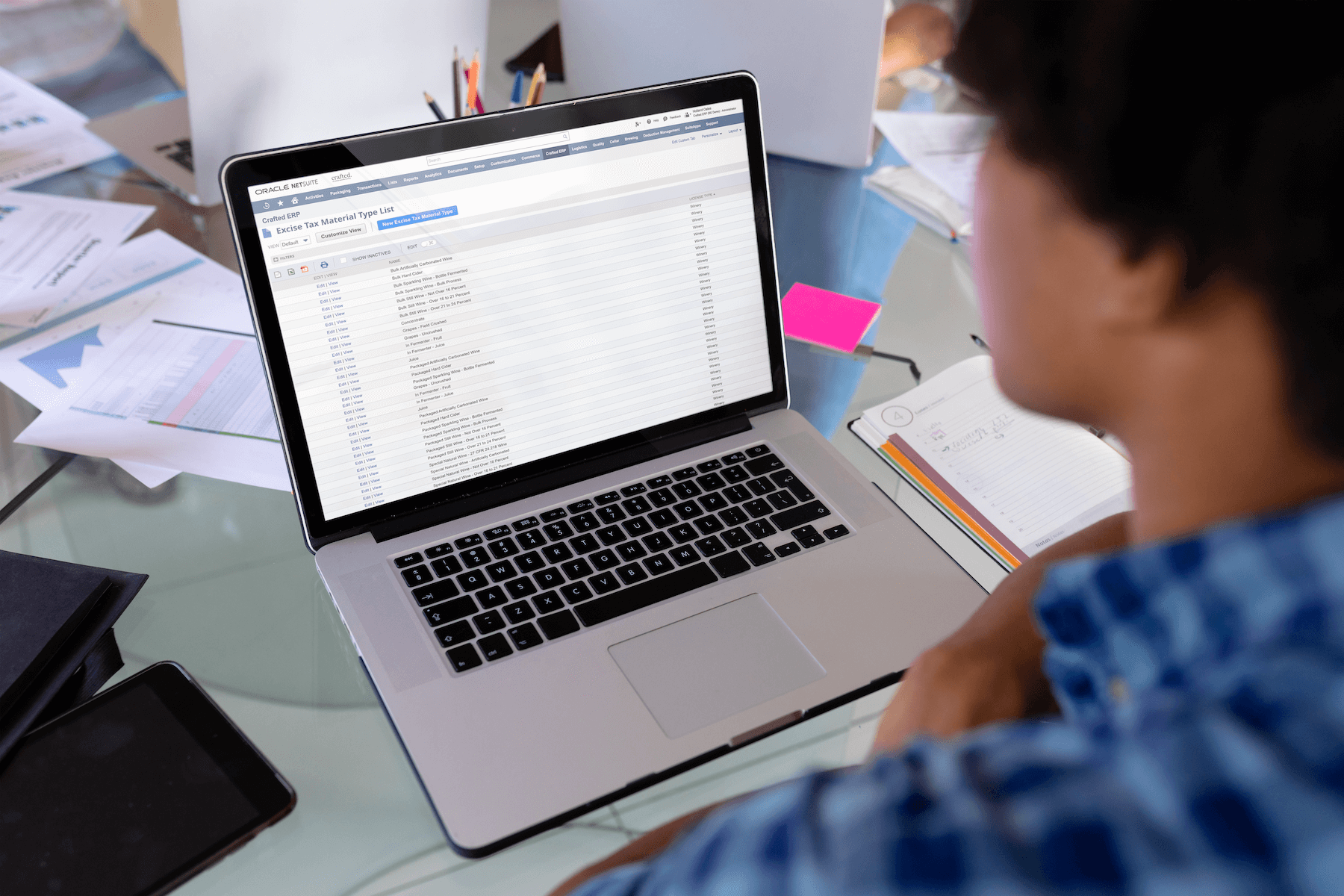

Modern ERP systems designed specifically for beverage alcohol can transform compliance from a burden into a strategic asset. ERP software integrates beverage operations across production, inventory management, sales and compliance, and provides a single database of business information.

Critical ERP capabilities include:

- Live financial updates: Gain a 360 view of cash flow, costs and revenue

- Automated license tracking: Never miss a renewal deadline

- Integrated tax compliance: Calculate and remit across jurisdictions

- Label management: Centralized storage for TTB and state approvals

- Real-time inventory: Visibility across all channels and locations

- Intelligent order routing: Automatic compliance checking before fulfillment

- Distribution software integrations: Sync inventory and outbound data with distribution and DTC software systems

Crafted ERP BevX specifically addresses the unique challenges of DTC shipping in the beverage alcohol industry. Unlike generic business software that requires extensive customization, BevX comes pre-configured with alcohol-specific workflows, compliance rules and reporting requirements.

The platform automates state and federal compliance reporting and generates the documentation required for audit trails. This purpose-built approach means producers can launch DTC programs faster while feeling confident about maintaining compliance.

Craig Cordes, Big Easy Blends co-founder and CFO, explains, “We selected Crafted ERP because of the multi-category compliance the software offers. Some software solutions offer just one, but Crafted offers the three we needed — wine, distilled spirits and beer — to help spearhead our compliance.”

4 Strategic DTC Moves for 2025 and Beyond

The trajectory is clear: DTC alcohol regulations will continue to expand access, driven by consumer demand, producer advocacy and the proven success of existing programs. To better prepare your beverage business for changes to shipping laws, consider these four ways to accelerate your DTC strategy.

- Build for tomorrow’s market: Invest in scalable infrastructure that quickly adapts to new state openings. The Mississippi and Arkansas examples show how rapidly markets can shift.

- Document everything: As DTC volume grows, expect increased regulatory scrutiny. Comprehensive documentation and audit trails aren’t just compliance requirements — they’re business insurance.

- Consider geographic strategy: Reciprocity requirements and production caps may favor strategic facility placement or partnership structures.

- Embrace technology: Manual compliance management becomes impossible at scale. Technology platforms that automate compliance can reduce workload and streamline operational efficiency.

The Bottom Line

DTC sales have evolved from a niche channel to a strategic imperative. The question facing producers isn’t whether to pursue DTC but how to build programs that balance compliance requirements with customer experience and operational efficiency. Those who master this balance will gain a powerful competitive advantage in an increasingly DTC world.

Ready to build a scalable DTC operation? Let’s discuss how Crafted ERP can optimize compliance while accelerating growth.