In the distilling industry, producing quality spirits is just one facet of the operation. Equally important is managing the intricate financial obligations associated with the business. Central to these responsibilities is the distilled spirits excise tax. Proper management and reporting of this tax are essential, not just for regulatory compliance but also for the financial stability of your distillery. While the reporting process for craft spirits production is complex and presents many challenges for distilleries, having the right tools in place can help compliance and accounting teams save valuable time and money.

The Role and Complexities of Distilled Spirits Excise Tax Reporting

Excise taxes, often known as the “sin tax,” is a government levy imposed on specific goods, particularly those deemed harmful or linked to health issues. In the alcoholic beverage industry, this tax is a cornerstone of revenue collection, playing a crucial role in the associated cost of products. Such taxes vary depending on the type, quantity and production method of the alcohol.

Understanding and managing excise taxes is no small feat. It entails detailed record keeping, continuous monitoring of regulatory changes and accurate accounting. Failure to navigate through this maze can lead to financial ramifications and product prices that are divergent from what your customers expect.

Consequences of Misreporting

Misreporting excise tax is more common than perceived. Businesses often slip in their reports due to manual errors, lack of knowledge in tax rates or oversight of regulatory changes. This misreporting, whether unintentional or intentional, can trigger audits, financial penalties and in dire situations, even invite legal action.

Implications also reach beyond monetary aspects. A distillery’s reputation can suffer a blow if found noncompliant. Accurate and compliant excise tax reporting isn’t about law adherence alone, it represents a crucial aspect of a business’s financial health and public impression.

Challenges in Excise Tax Reporting and the Power of Distillery ERP

Navigating the complexities of distilled spirits excise tax reporting can be like walking through a maze full of surprises, with potential problems at every turn.

Roadblocks in Reporting

A major hurdle that distilleries face is keeping up to date with evolving tax regulations. Governments frequently tweak excise tax rates or compliance requirements. Staying informed of these changes is critical. It can often feel like a daunting task due to the sheer volume of information to be monitored.

Another challenge is the issue of input errors. Distilleries, particularly smaller ones, often rely on traditional bookkeeping methods which involve manual calculations, often kept on static spreadsheets. This opens the door for both simple mathematical mistakes and more complex errors such as incorrect tax classifications or omitting taxable items. Inaccurate reports and systematic errors in the bookkeeping process not only lead to incorrect tax reporting but also to major financial penalties if any error is spotted by regulatory authorities.

The Transformative Role of Distillery Management Software

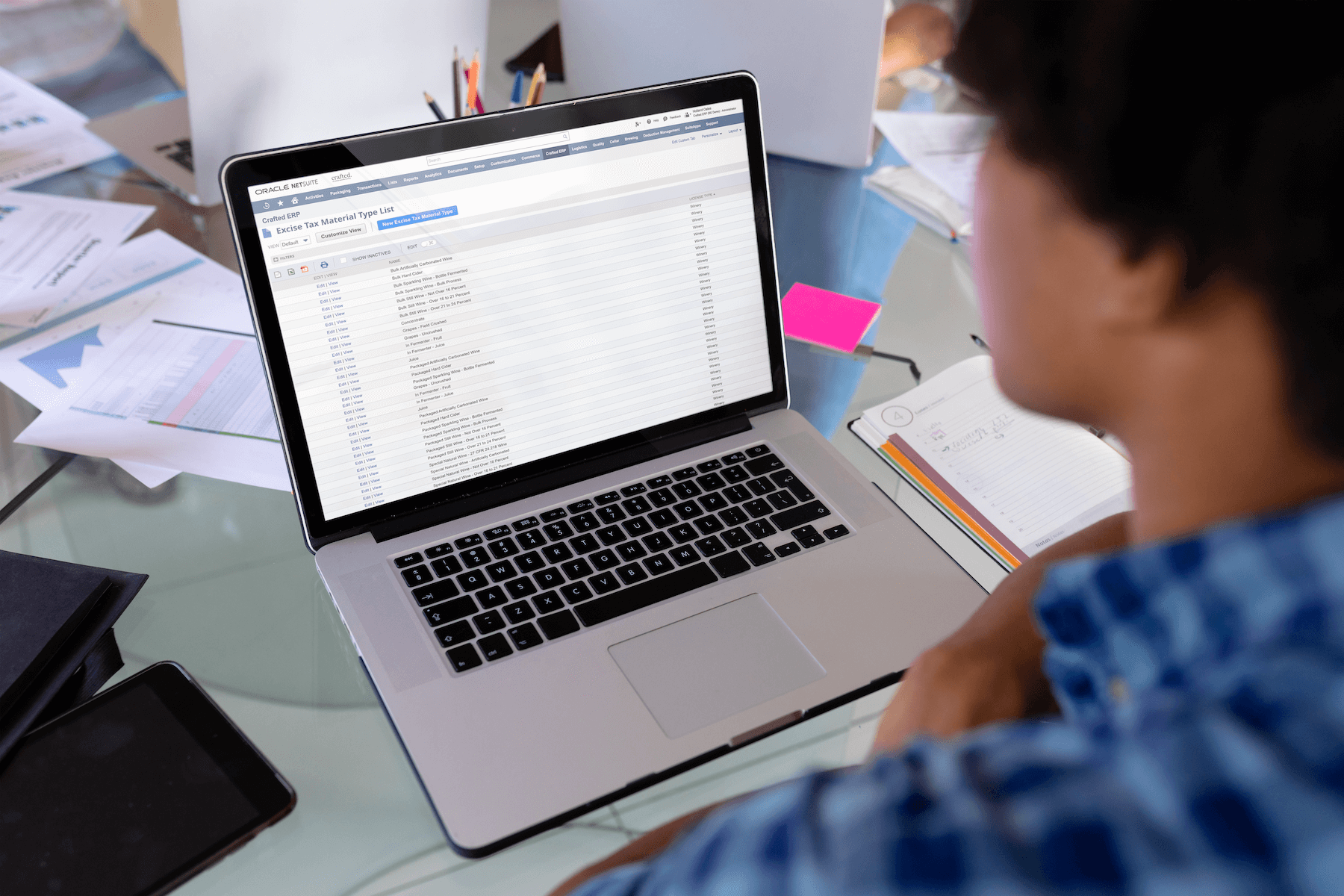

Distillery ERP software turns these complex issues into manageable tasks. These comprehensive “enterprise resource planning” software tools streamline business processes from production to sales to compliance and distilled spirits tax reporting.

A robust ERP system automates tax calculations according to current tax laws, eliminating the risk of human-prone errors. It also provides real-time updates on changes in regulations, ensuring distilleries align with the latest requirements. With a single click, a purpose-built ERP system can generate ready-to-submit tax reports, reducing the administrative burden significantly.

Under-reporting production or sales can open up a distillery to penalties from state or federal regulatory entities. Implementing distillery management software would rectify reporting and protect the business from future legal troubles, offering much needed peace of mind.

Embracing the power of ERP solutions like Crafted ERP in distilled spirits excise tax reporting does not replace human effort. It augments it. It empowers distilleries to refocus their energies on creating quality spirits, leaving the tricky tax reporting details to the ERP.

“As a direct result of implementing Crafted, we were able to identify and recover more than $1,000,000 in excise tax overpayment.”

Anonymous CFO at a leading distillery

Benefits of Embracing Modern Distillery Management Solutions

Investing in modern distillery management solutions like ERP software brings several distinct advantages. It reshapes how distilleries handle operations, including the critical aspect of excise tax reporting.

Minimizing Human Error with Automation and Accuracy

ERP systems significantly reduce the possibility of manual errors by automating calculations and tax classifications. It ensures correct tax rates apply to the appropriate products, acknowledging variations mandated by different jurisdictions or changing laws.

For distilleries expanding distribution, each state may have unique tax rates and categories. Tracking and applying these manually could be prone to errors. With a distillery ERP solution, tax calculations are adjusted automatically, saving valuable staff time and increasing reporting accuracy.

Centralizing Distillery Operations From Production to Sales

Distilled spirits excise tax reporting is one function of an ERP, but it also provides a consolidated platform for managing all aspects of distillery operations. It integrates production, inventory management, sales and finance management into a unified system. A holistic view of operations is possible, which assists in informed decision making and gives better control over the business.

For any fast-growing distillery that struggles with tracking raw material usage, production levels and product sales, distillery management software can offer an integrated view of the entire operations. This alignment streamlines processes and presents opportunities to optimize resource utilization and improve cost efficiencies.

Embracing modern distillery management solutions is a strategic step towards future-proofing operations. Investments in such technology may seem hefty at first, but long-term benefits like accuracy, efficiency and regulatory compliance make it a worthy endeavor.

Don’t Pay More Than You Owe

Excise tax reporting is a critical, complex facet of running a distillery. Navigating through the maze of ever-evolving regulations and avoiding manual errors is challenging. Missteps in this domain can lead to substantial financial penalties and damage to a distillery’s reputation.

ERP solutions offer a transformative approach to these challenges. They automate the distilled spirits excise tax reporting process, minimizing human error. Automatic updates on regulatory changes and preformatted, ready-to-submit tax reports help distilleries ensure compliance without having to wade through every tax law amendment.

These systems also provide a platform for managing other operations, from production to sales to supply chain and more. A unified view equips distilleries with insights needed for informed operational and strategic decisions. Distillery ERP software is a game changer for craft spirits producers, offering accuracy, efficiency and a roadmap for scalable growth.

Adopting modern distillery management solutions is about more than overcoming challenges; it’s about setting the stage for success in a competitive industry. This investment yields accurate reporting, streamlined operations, regulatory compliance and peace of mind. These benefits make it a worthy pursuit for any distillery aiming to stand tall and steadfast in the face of complexity.

Crafted ERP offers the most comprehensive distillery management solution on the market. Powered through NetSuite, Crafted provides a 360-degree view of your craft spirits business. If you’re struggling with compliance and TTB reporting, or if you need a unified approach to managing financials, reach out to our team of experienced bev-alc professionals who can walk you through our solution.